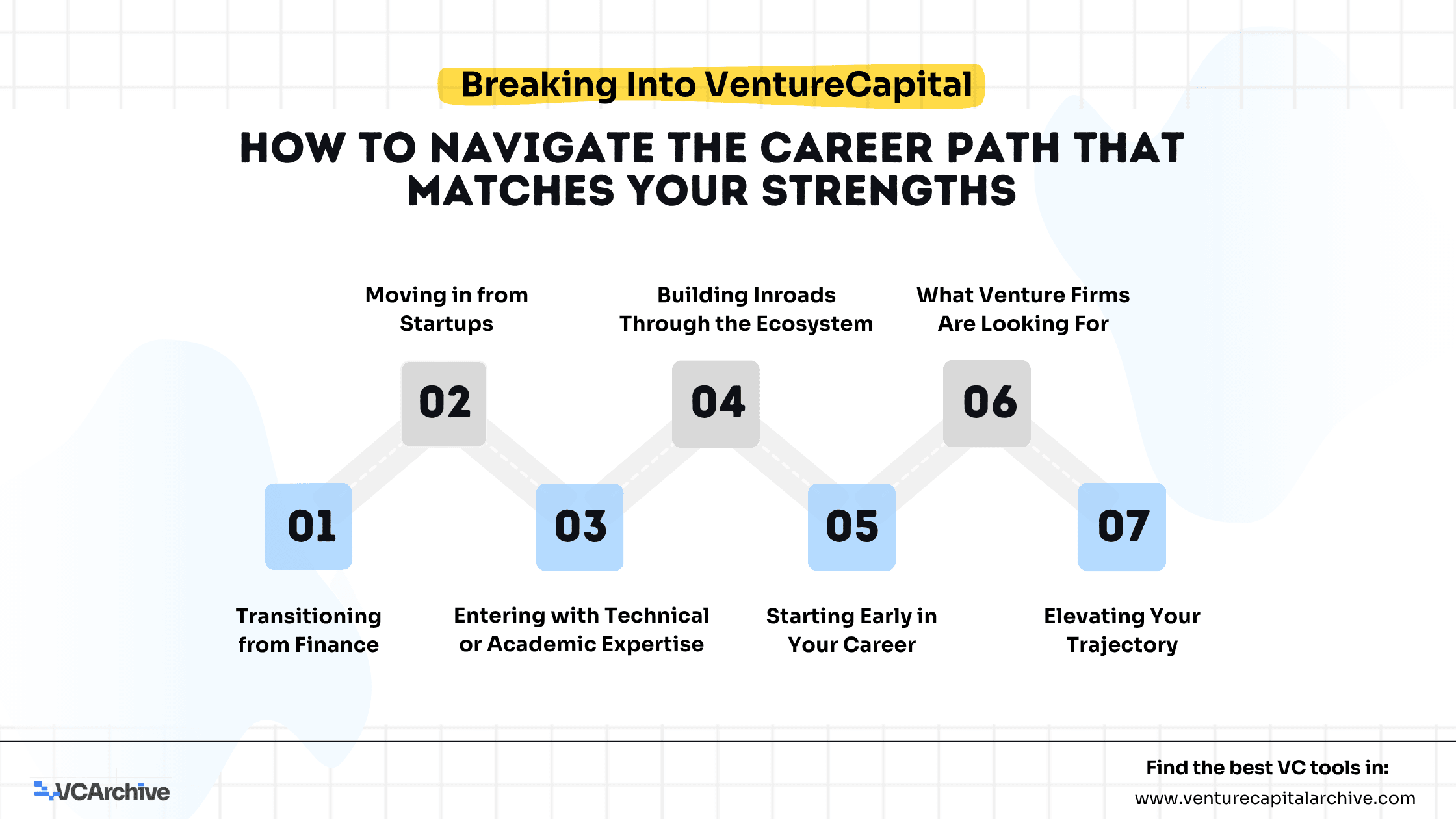

Breaking Into Venture Capital: How to Navigate the Career Path That Matches Your Strengths

Yet for all its appeal, the venture capital industry remains difficult to access. Firms rarely post openings, and career tracks are often undefined. Success depends less on credentials and more on clarity of thinking, depth of networks, and the ability to add value early. To break in, it’s critical to understand the most common entry routes—and to choose the one that aligns with your unique strengths.

Transitioning from Finance

Professionals from investment banking, private equity, or consulting often transition into VC as analysts or associates. Their experience in market analysis, financial modeling, and deal execution offers a strong foundation. However, excelling in venture requires more than technical skills. It calls for conviction in uncertain markets and the ability to support founders beyond financial advice.

Moving in from Startups

Operators and founders bring deep insight into execution, product, and growth. Whether you’ve built a company or led a key function in one, your hands-on experience makes you a valuable partner to early-stage entrepreneurs. Venture firms increasingly seek those who understand the real challenges of scaling a business and can spot signs of traction before others do.

Entering with Technical or Academic Expertise

PhDs, engineers, and domain specialists often join VC firms focused on deep tech, healthcare, or climate innovation. Your ability to assess complex technologies, evaluate IP defensibility, and understand frontier markets can differentiate you, especially when paired with commercial curiosity and a willingness to learn investment strategy.

Building Inroads Through the Ecosystem

If you’ve led an accelerator, built founder communities, launched a podcast, or managed angel networks, you’ve likely developed access and influence that VC firms value. Ecosystem insiders who consistently engage with high-potential startups can create opportunities to join firms through platform roles, venture scout programs, or investment team support.

Starting Early in Your Career

For students and recent graduates, the most viable entry point is through analyst programs, venture fellowships, or internships. These roles are limited and competitive. Candidates who stand out tend to have a demonstrated interest in startups, exposure to investing, or public content that shows their thinking. A clear thesis and strong personal brand go a long way.

What Venture Firms Are Looking For

Regardless of the path you take, most firms evaluate candidates on three dimensions

Founder Empathy

Do you understand the emotional and strategic challenges founders face, and can you earn their trust?

Investment Judgment

Can you make decisions under uncertainty and recognize patterns others overlook?

Network Access

Can you unlock valuable deal flow, talent, or strategic partnerships for the portfolio?

You do not need to master all three on day one. But you must lead with one and signal your ability to develop the others.

Elevating Your Trajectory

There is no formula for getting into venture capital. The industry rewards those who act like investors before they are given the title. That means writing about sectors you know, helping founders in your network, building small portfolios, or sourcing deals for others. It also means showing up consistently, learning in public, and contributing to the ecosystem without waiting for permission.

If you approach this space with clarity, consistency, and authentic curiosity, doors will begin to open.

Venture capital is not about having the perfect background. It is about having a point of view, earning trust, and delivering value before anyone asks you to.

Start there. You might already be closer than you think.